Introduction

A Bangalore based Fintech (The Company), having Pan India Presence with revenue of more than 100 CR annually, uses Payment Gateway to cater to Multi National Organisation. They specialize in providing Multinational Organizations (MNOs) with secure and efficient payment gateway solutions.This essentially allows MNOs to accept online payments seamlessly from various sources, likely including credit cards,debit cards, and potentially other digital payment methods.

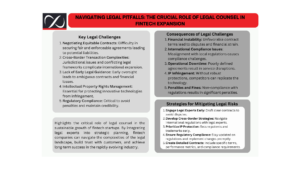

It’s rapid expansion highlighted several legal challenges common to fintech startups. First, negotiating equitable and enforceable contracts was difficult, leading to unfavorable terms and potential liabilities. Second, expanding into international markets brought jurisdictional complexities and conflicts over legal frameworks. Third, the lack of early legal guidance resulted in various contractual pitfalls. Fourth, managing intellectual property rights was essential to protect innovative technologies. Finally, ensuring regulatory compliance was crucial to avoid penalties and maintain credibility. Addressing these issues through proactive legal strategies is vital for the sustainable growth of fintech ventures. This article delves into the specific problems faced by fintech startups, using The Company Payment Gateway as a case study, and provides legal suggestions to help avoid these pitfalls.

The problems:

Negotiating Equitable Contracts

Payment Gateway faced significant difficulties in negotiating contracts with merchants and service providers. In the absence of specialized legal knowledge, the company inadvertently accepted unfavorable terms, leading to disputes. For example, one contract allowed a major merchant to terminate the agreement with minimal notice, creating financial instability for The Company. This lack of clear and comprehensive agreements tailored to their business needs increased the likelihood of legal disputes and undermined the company’s credibility.

Moreover, unclear revenue-sharing agreements can lead to prolonged financial instability. For instance, The Company Payment Gateway entered into a revenue-sharing agreement with a large retail chain. The contract was ambiguous about the allocation of transaction fees, leading to disputes that took months to resolve. This not only strained the relationship with the retail chain but also caused significant financial strain.

Cross-Border Transaction Complexities

As The Company Payment Gateway expanded into international markets, they encountered jurisdictional complexities and conflicting legal frameworks. Each country has its own set of financial regulations, leading to disputes over contractual obligations and liability allocation. For instance, a dispute arose with a European partner over differing data protection standards. The misalignment between the contractual terms and local regulations created compliance challenges and strained business relationships.

Additionally, cross-border transactions introduce complexities related to currency exchange, tax obligations, and compliance with international anti-money laundering (AML) regulations. The Company’s Payment Gateway faced issues when their international transactions did not comply with local AML laws, leading to investigations and fines. Navigating these complexities without specialized legal counsel can result in significant financial and reputational damage.

Lack of Early Legal Guidance

Without early legal counsel, The Company Payment Gateway entered into several contracts with ambiguous terms, resulting in disputes and financial losses. For example, a poorly defined service level agreement (SLA) with a technology provider led to prolonged downtimes and customer dissatisfaction. Proactive legal assistance from the outset could have identified potential issues and recommended strategies to address them, minimizing the risk of disputes and preserving the company’s reputation.

The absence of early legal guidance also affected their investor agreements. The Company Payment Gateway agreed to terms with investors that later proved restrictive, limiting their operational flexibility and strategic decision-making. Early engagement with legal experts could have ensured that investment terms were more favorable and aligned with the company’s long-term goals.

Intellectual Property Rights Management

Protecting proprietary technology and innovation was a critical challenge for The Company Payment Gateway. The company faced disputes over intellectual property (IP) infringement when competitors attempted to replicate their technology. Without robust legal protections, The Company risked losing its competitive edge and market share. This highlighted the need for comprehensive IP strategies, including securing patents and trademarks.

Moreover, the fintech industry often involves developing new algorithms and software. The Company Payment Gateway developed a unique algorithm for fraud detection but failed to secure a patent early on. A competitor launched a similar product, leading to a costly and time-consuming IP dispute. This situation underscores the importance of proactively managing IP rights to protect innovations and maintain a competitive advantage.

Regulatory Compliance

Ensuring adherence to evolving financial regulations was crucial for The Company Payment Gateway. The company experienced challenges in keeping up with new regulatory requirements, leading to potential penalties and compliance issues. For example, changes in data protection laws required significant adjustments to their data handling practices. Failure to comply with these regulations resulted in fines and reputational damage.

Additionally, fintech companies must navigate regulations specific to their industry, such as the Payment Card Industry Data Security Standard (PCI DSS) for handling card transactions. The Company Payment Gateway faced fines and lost clients due to non-compliance with PCI DSS. Staying informed about and compliant with industry-specific regulations is essential to avoid penalties and maintain trust with customers and partners.

Suggestions to Avoid These Instances

- Engage Legal Experts Early: Fintech startups should seek legal counsel early in their journey to draft and negotiate clear, comprehensive contracts. Legal experts can help ensure that agreements are equitable and enforceable, protecting the company from unfavorable terms and potential liabilities. Early engagement with legal professionals can also help identify and address potential legal issues before they escalate.Legal counsel can assist in drafting contracts that clearly define the responsibilities and expectations of all parties involved. This includes detailed revenue-sharing agreements, termination clauses, and SLAs that specify performance metrics and penalties for non-compliance. Clear contracts reduce the risk of disputes and provide a solid foundation for business relationships.

- Develop Robust Cross-Border Strategies: To navigate the complexities of international expansion, fintech startups should work with legal experts who specialize in cross-border transactions. These experts can help anticipate and address jurisdictional conflicts, ensuring compliance with varying legal frameworks. This approach minimizes risks and fosters strong international partnerships.Legal experts can assist in understanding local regulations, tax obligations, and currency exchange laws. They can also ensure compliance with international AML regulations and data protection standards. Developing a robust cross-border strategy that includes legal guidance helps fintech companies expand smoothly and mitigate risks associated with international operations.

- Prioritize Intellectual Property Protection: Protecting intellectual property is essential for maintaining a competitive edge. Fintech startups should develop comprehensive IP strategies, including securing patents and trademarks and implementing measures to prevent and address IP theft. Engaging with IP specialists can help safeguard proprietary technology and innovation, attracting investors and supporting business growth.Securing patents early in the development process protects innovations and deters competitors from copying proprietary technology. Regularly reviewing and updating IP portfolios ensures ongoing protection and adaptation to new developments. Fintech startups should also consider international IP protection to secure their innovations in multiple markets.

- Ensure Regulatory Compliance: Staying informed about evolving financial regulations and implementing necessary adjustments promptly is crucial for fintech startups. Engaging with legal experts who specialize in financial regulations can help navigate this complex landscape, ensuring compliance and minimizing legal risks. This proactive approach helps avoid penalties and maintain operational continuity. Legal counsel can assist in developing compliance programs that include regular audits, employee training, and updates to policies and procedures. Staying ahead of regulatory changes and proactively addressing compliance requirements ensures that fintech companies maintain trust with regulators, customers, and partners.

- Create Clear and Detailed Contracts: Developing clear and detailed contracts is essential to minimize disputes and protect business interests. Contracts should include specific terms and conditions, performance metrics, and compliance requirements. Legal experts can help draft agreements that are tailored to the company’s needs, reducing the risk of misunderstandings and legal conflicts. Including clear dispute resolution mechanisms, such as arbitration clauses, can help resolve conflicts quickly and cost-effectively. Detailed contracts that outline all aspects of the business relationship provide clarity and reduce the risk of litigation, fostering stronger partnerships and business stability.

Conclusion

Fintech startups in India, such as The Company Payment Gateway, face significant legal challenges that can hinder their growth and sustainability. These challenges include negotiating equitable contracts, navigating cross-border transaction complexities, managing intellectual property rights, and ensuring regulatory compliance. By engaging legal experts early, developing robust cross-border strategies, prioritizing intellectual property protection, ensuring regulatory compliance, and creating clear and detailed contracts, fintech startups can mitigate these risks and foster long-term success. Proactive legal strategies are essential for building trust with customers, maintaining credibility, and achieving sustainable growth in the rapidly evolving fintech industry. The experiences of The Company Payment Gateway illustrate the importance of integrating competent legal counsel into the strategic planning of fintech startups to navigate the complexities of the legal landscape effectively.