Rapidly growing greentech sector offers innovative solutions to environmental challenges. However, translating these solutions into successful business models hinges on clear contractual agreements. A critical, yet often overlooked, aspect concerns ownership of the environmental benefits generated by greentech solutions. This ownership becomes crucial when multiple parties are involved, such as a company deploying a solar energy solution and a government agency offering incentives for reduced carbon emissions. Who gets to claim the carbon credits generated by the solar panels? Can both parties share ownership?

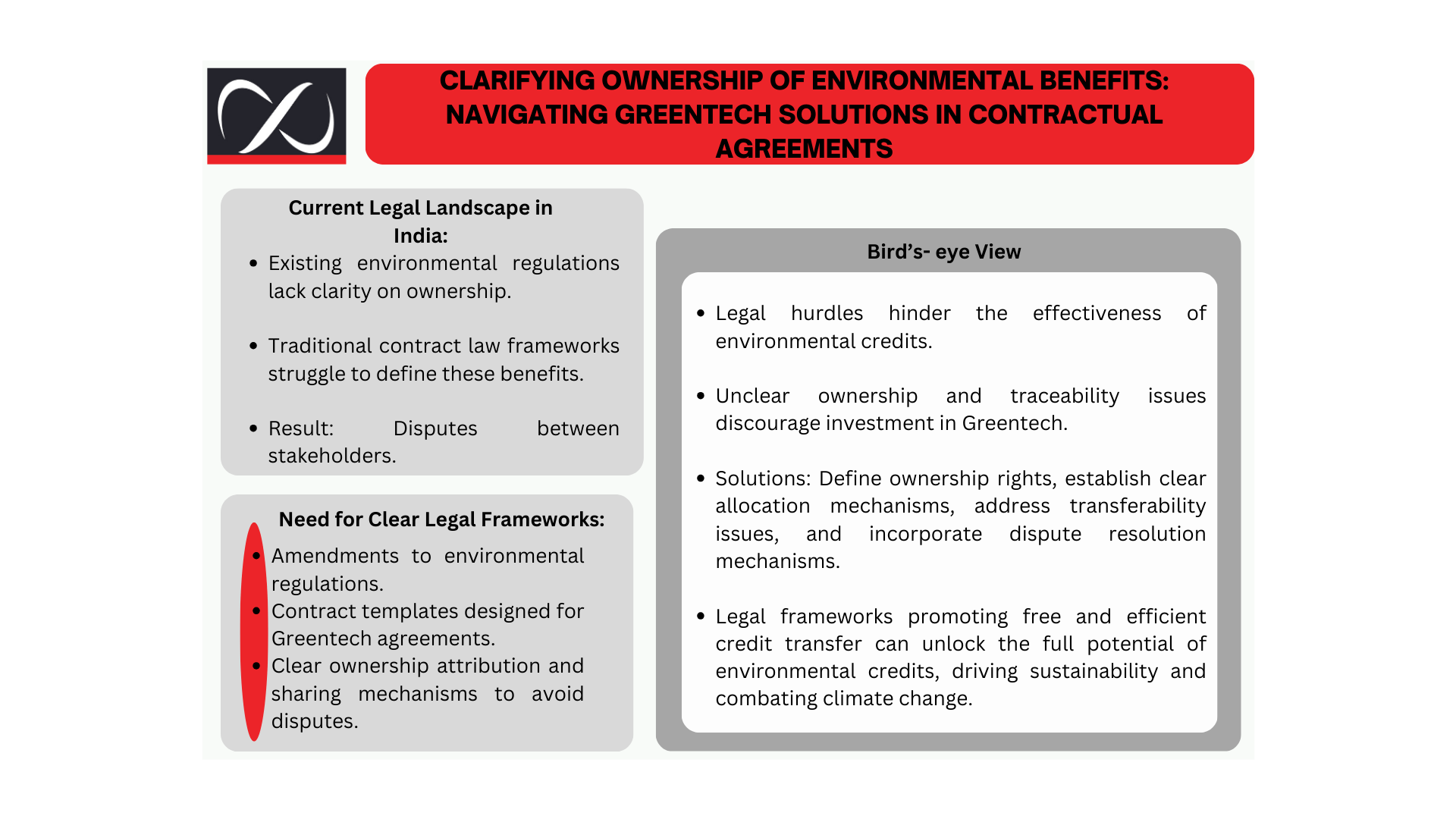

The current legal landscape in India presents challenges in addressing these questions. Existing environmental regulations might not explicitly address ownership of environmental benefits arising from greentech solutions. Traditional contract law frameworks might struggle to define and assign value to these benefits. This ambiguity can lead to disputes between stakeholders. For instance, a company installing energy-efficient lighting in a building might disagree with the building owner regarding who gets to claim the associated energy savings and potential tax benefits.

To navigate these complexities and unlock the full potential of greentech solutions, clear legal frameworks are needed. This might involve amendments to environmental regulations to recognize and define ownership of environmental benefits. Contract templates specifically designed for greentech agreements, outlining ownership attribution and potential sharing mechanisms, can provide much-needed clarity and avoid disputes.

Case 1: The Wind Farm Feud

A developer based in Delhi (The Company) with the annual revenue of Rs. 10 Crores, partnered with GC, an investor, to build a wind farm. The contract vaguely defined ownership of Renewable Energy Certificates (RECs) generated by the project. The Company, responsible for construction and operation, believed they owned the RECs. However, GC, citing their financial contribution, contended they had ownership rights.

Conflict and Lost Revenue: The lack of clear ownership clauses led to a legal battle. Both parties claimed entitlement to the revenue generated from the sale of RECs, critical for project profitability. The dispute stalled project expansion plans and discouraged potential investors.

Legal Solution: To prevent such conflicts, contracts can explicitly define ownership of RECs based on predetermined criteria, such as investment share or operational responsibility. Additionally, the contract could establish a revenue-sharing model, ensuring both parties benefit from the RECs generated.

Case 2: The Forest Carbon Conundrum

A social forestry project in Maharashtra generated carbon credits through reforestation efforts. The project developers, (The Company) aimed to sell these credits to a power company for offsetting their emissions. However, the contract with the government agency overseeing the project lacked clarity on the tradability of the credits. The agency interpreted the agreement as restricting the credits to internal use within the state, hindering (The Company)s’ ability to find buyers in the national market.

Limited Market, Reduced Benefits: The ambiguity in the contract limited the tradability of the credits, restricting GSs’ potential revenue and disincentivizing future investments in similar projects.

Legal Solution: To address this, India can consider adopting standardized contracts for environmental credit generation that explicitly define the tradability of credits. This clarity will provide certainty to project developers and attract more participants to the emissions market.

Challenges in Ownership and Tradability:

Despite the potential value of environmental credits, disputes often arise over the ownership and tradability of these credits in Greentech projects. Some common challenges include:

- Unclear Ownership: In multi-stakeholder projects involving investors, developers, and technology providers, determining ownership of environmental credits can be ambiguous. Lack of clarity in contractual agreements regarding ownership rights can lead to conflicts over entitlement and distribution of credits.

- Tradability Issues: Even if ownership is established, questions may arise regarding the tradability of environmental credits. Restrictions on the transferability of credits or conflicting interpretations of contractual provisions can impede the trading of credits in emissions markets, limiting their value and utility.

Strategies for Clarifying Ownership in Contracts:

To mitigate the risk of disputes and ensure clarity regarding ownership of environmental benefits in Greentech projects, it is essential to incorporate the following strategies into contractual agreements:

- Define Ownership Rights: Clearly specify ownership rights and responsibilities for environmental credits in contractual agreements upfront. Identify the parties entitled to claim credits and outline the conditions under which credits are generated, allocated, and transferred.

- Establish Clear Allocation Mechanisms: Implement transparent allocation mechanisms for environmental credits based on project contributions, investments, or performance metrics. Define criteria for determining credit entitlement and distribution among project stakeholders to avoid ambiguity and disputes.

- Address Transferability Issues: Anticipate and address potential issues related to the transferability of environmental credits in contractual agreements. Clarify any restrictions or limitations on the transfer of credits and establish procedures for obtaining consent or approval from relevant parties.

- Include Dispute Resolution Mechanisms: Incorporate effective dispute resolution mechanisms, such as arbitration or mediation clauses, to resolve conflicts related to ownership and tradability of environmental credits. Provide a framework for addressing disagreements and facilitating negotiations among parties to reach mutually acceptable solutions.

Conclusion:

Despite the immense potential of environmental credits to incentivize green practices and combat climate change, legal hurdles surrounding ownership and tradability can significantly hinder their effectiveness. Unclear ownership structures in multi-stakeholder Greentech projects often lead to disputes. Contracts with ambiguous language regarding ownership rights create confusion and conflict between investors, developers, and technology providers when it comes to the entitlement and distribution of credits generated.

Furthermore, even when ownership is established, the tradability of these credits remains an issue. Restrictions on transferring credits can limit their value and utility. Conflicting interpretations of contractual provisions regarding tradability can further impede participation in emissions markets. These challenges discourage investment in Greentech projects and ultimately undermine the overall effectiveness of environmental credit programs. By defining ownership rights, establishing clear allocation mechanisms, addressing transferability issues, and incorporating effective dispute resolution mechanisms into contracts, stakeholders can prevent conflicts and maximize the value of environmental credits. With a strategic approach to contractual agreements, Greentech projects can unlock their full potential to drive sustainability, mitigate climate change, and create lasting environmental impact.

Finally, legal frameworks that promote the free and efficient transfer of credits should be implemented. By tackling these legal challenges, India can unlock the full potential of environmental credits, creating a robust and efficient emissions market that incentivizes green innovation and propels the nation towards a sustainable future.